Looming Congressional budget battles notwithstanding, 2024 is expected to provide federal government contractors with a bounty of opportunities.

Bloomberg Government projects at least $762 billion in contract spending by the U.S. government in fiscal 2024, driven by splurges in such areas as cloud computing, defense base logistics and supply chain, financial services, facilities services and digital services. Under the Biden Administration’s proposed budget, according to Bloomberg, Health and Human Services, Treasury, the Environmental Protection Agency and the National Science Foundation are among the federal departments projected to see the largest increases in contract spending.

In light of the expected surge in federal contract spending, the magnitude of which ultimately will be determined during what figures to be a contentious appropriations process in the U.S. Congress, the big question government contracting firms should be asking themselves entering 2024 is, “How well positioned are we internally to pounce on contracting opportunities when they arise?”

Arriving at a satisfactory answer to that question depends largely on a firm’s forecasting capabilities, particularly as they apply to areas like indirect rates, projects, resources and pipeline. Accurate forecasting informs the planning and strategy that are so critical to a firm’s project performance and ability to grow. It helps firms navigate uncertainty and risk, run projects more efficiently, deliver positive project outcomes more consistently, attract and retain talent, and land more of the kind of business they most desire.

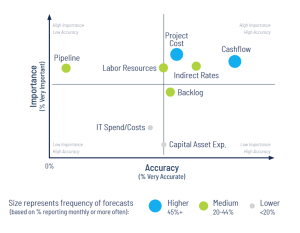

Yet forecasting is an area where many firms could stand to improve, as findings from Unanet’s 2023 GAUGE benchmarking report (available via free download here) make clear. Based on survey responses from about 1,100 top government contracting firm decision-makers, the 2023 Report found that almost one-quarter of these execs believe their firm’s pipeline forecasting lacks accuracy. Just 18% categorized their firm’s pipeline forecasting as “very accurate.”

Meanwhile, some 70% of respondents indicated their firm continues to rely on spreadsheets to forecast resources. Almost half — 47% — of firms said they have no forecasting policies whatsoever, or are just in the process of creating them. Only about one in five firms has forecasting policies that people strictly follow. And forecasting remains among the top three project-management challenges for these firms.

What this suggests is that there are real opportunities for government contracting firms to use better forecasting to pounce on the plentiful project opportunities Uncle Sam likely will provide in 2024 and beyond. To excel at forecasting, firms need a few fundamentals in place, along with the right enterprise resource planning (ERP) and customer relationship management (CRM) tools.

First and foremost, people, processes, and technology must be aligned across the organization — starting with project and finance teams — and made possible via a single digital environment in which ERP and CRM systems are fully integrated. Within that environment, people across the firm need to be connected, communicating, and collaborating openly and easily. They should be synched to a single source of organizational data because quality forecasting is predicated on fresh, accurate input from multiple parties. It’s also important for firms to be well-versed in both bottom-up and top-down forecasting methodologies, as each has a role to play in a firm’s decision-making.

Once these fundamentals are in place, then firms can start leveraging specific forecasting tools to help with their planning and pursuits, focusing on four key areas where forecasting is particularly important:

- Tools to help with indirect rate forecasting. The quality of a firm’s indirect rate forecasting can play a huge role not only in its ability to win government contracts, but also in how those projects perform from a profitability standpoint. For maximum accuracy, you’ll need tools that give you clear insight into projected sales, project costs, overhead and general and administrative (G&A) costs. Those tools should accommodate multiple rate methodologies and contract structures, and be able to offer insight across multiple time horizons, out to five years. Given how many teams and individuals typically must provide input to develop indirect rates, tools that enable them to easily collaborate around a single trusted data source are a must.

- Tools to help with project cost forecasting. Forecasting project costs, revenue and cash flow can help a firm allocate resources more efficiently, set realistic financial targets and make informed decisions regarding investments, expenses, and pricing strategies. Having tools that enable a firm to group projects (by program, customer, product, business unit, etc.) can simplify the forecasting process, especially in the long-range timeframe (three to five years). This provides the ability to view forecasts in aggregate to better understand expected customer demand, firm capacity, and potential growth.

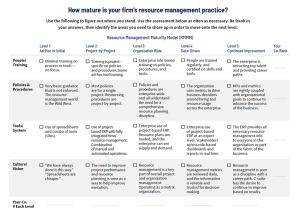

Because resource forecasting is a big part of the project forecast equation, firms also need sharp insight into resource availability, skillsets, demand for labor and other factors to inform their pursuits and make the right resource allocation calls to avoid shortages or excesses that can lead to delays, cost overruns and quality issues. Intelligent algorithm-driven tools can help guide these decisions. Check out the graphic below to see how your firm’s resource management practice measures up.

- Tools to help with pipeline forecasting. Maximizing the many federal contracting opportunities that figure to become available in 2024 and beyond also requires firms to be on-point with their pipeline forecasting — proposals submitted and to be submitted, future revenue for awarded work, etc. A good CRM system is a must, preferably one with an opportunity pipeline tool to help decision-makers clearly understand revenue velocity and resource needs for the future. The right system should provide a complete visualization of opportunities the firm is pursuing.

Sometime early in 2024, hopefully, we’ll have clarity around how much federal contracting dollars will be flowing from which agencies in 2024. And once that clarity comes, firms with strong forecasting capabilities will be best positioned to take advantage of those opportunities.

As head of Unanet’s GovCon business unit, Chris Crowder collaborates with customers and other key stakeholders to grow and enhance the customer experience. Prior to joining Unanet, Chris was a principal at Baker Tilly, where he focused on business solutions for government contractors and federal agencies. He serves on the board of SECAF (Small & Emerging Contractors Advisory Forum) and is an active member of the Professional Services Council, the Northern Virginia Technology Council and other industry organizations. https://unanet.com/

Leave a Reply

You must be logged in to post a comment.