Government organizations strive to become more efficient, effective, and responsive to the citizens they serve. Citizens expect government to be accountable about how their well-earned tax dollars are being spent. That’s why it is increasingly important that government balances equitable service to citizens while increasing revenue by proactively detecting tax fraud and noncompliance.

While the US Internal Revenue Service (IRS) works to reduce the tax gap (the amount of tax liability faced by taxpayers that is not paid on time), there are still issues with underreporting. It is important for government agencies to counter fraud operations with scalable technology and processes that are flexible enough to quickly respond to suspicious activities.

In a recent IBM report, IBM highlights solutions for counter fraud and compliance in government. Using advanced analytics and investigative analysis, IBM solutions can help tax agencies avoid the pay-and-chase scenario by intercepting suspicious transactions in real time while detecting, identifying, and building cases against fraudulent activity. With these solutions, government agencies can detect, identify, and reduce tax fraud all while improving compliance.

A Paradigm Shift to Combatting Tax Fraud

Traditionally, agencies monitor taxpayer data through silos. Valuable sources of analytic data reside in many different system silos, such as tax returns, tax audits, justice, public safety, and social services in a government organization. The problem with silos, however, is that they create harmful intelligence gaps within the organization. This means that without interdepartmental intelligence and communications, suspicious activity and fraud patterns can go undetected. Additionally, disconnected fraud solutions decrease cost efficiency, since overall operating costs go up to manage various silos.

The IBM Counter Fraud Management Solution helps bridge these gaps with the following benefits:

- Eliminate information silos with an ecosystem of tightly woven capabilities that optimize big data and entity analytics.

- Expand observation space.

- Enable unified enterprise intelligence.

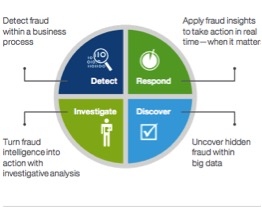

IBM’s solution applies a holistic approach:

When your agency applies this four-part strategy within the counter fraud management solution, you are better able to use your data to deliver strong insights and enable proactive decision-making. Here’s how your agency can apply the above diagram for counter fraud management:

- Detect. Determine the accurate identity of an individual through analytic models. Use intelligence from past discovery and investigation processes to recognize fraudulent activity patterns and highlight potential suspicious activity for further investigation by your teams.

- Respond. Differentiate legitimate submissions and tax returns while preventing suspicious actions by responding immediately to criminal patterns detected. Quick responses are the best way to deter criminals from pursuing further activity.

- Investigate. Perform and manage detailed inquiries into suspicious activity that enhance evidence compilation for prosecution and recovery of payments. Address fluid and constantly changing fraud schemes by leveraging new models and watch lists that are crucial to the feedback loop in the fraud management lifecycle.

- Discover. Use rich analytic capabilities to identify tax evasion and non-compliance. Retrospectively review historical data and analyze patterns and anomalies to quickly identify emerging fraud schemes.

As data and analytic capabilities of tax agencies evolve, so do tax fraud schemes. Agencies must stay vigilant by constant monitoring their models and responses. Merging individual rules, analytics, and techniques into seamless end-to-end operation provides advanced insights so that agencies can react in a faster, more targeted manner.

Leave a Reply

You must be logged in to post a comment.