Hey there. I’m Christopher Dorobek — the DorobekINSIDER — and welcome GovLoop’s DorobekINSIDER… where we focus on six words: Helping government do its job better.

On GovLoop’s DorobekINSIDER: SAMMIES 2014 — lessons learned from the government’s best and brightest: From Tom Fox from the Partnership for Public Service: Once you hear from the Sammies winners and the finalists, you realize that there is an incredible amount of work that’s going. Federal employees not only take great pride in what they do, but they’re achieving great things on behalf a their country.”

But up front:

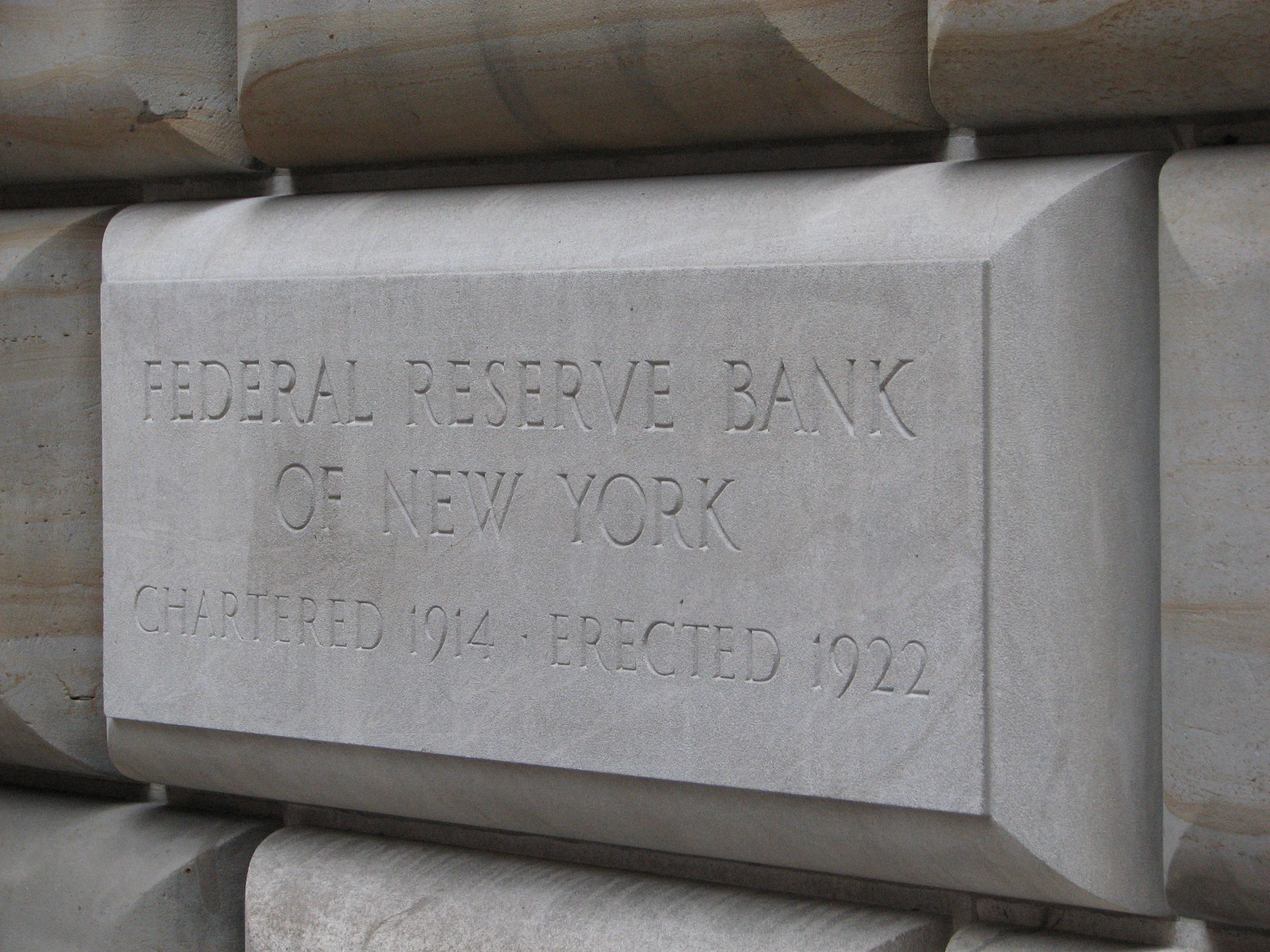

DorobekINSIDER: Revolving door – Wall Street edition

The revolving door is one of the most challenging issues for government — and one about which the government gets the most flack… and one that erodes the government’s faith in their government.

We discussed it here earlier this year, but the latest example comes from Wall Street.

ProPublica, the investigative reporting non-profit, working with public radio’s This American Life, has discovered recordings that seem to raise questions about the close ties between regulators and those regulated.

“The NY Federal Reserve is supposed to monitor big banks. But when Carmen Segarra was hired, what she witnessed inside the Fed was so alarming that she got a tiny recorder and started secretly taping,” This American Life reports.

From ProPublica:

Inside the New York Fed: secret recordings and a culture clash [ProPublica] Barely a year removed from the devastation of the 2008 financial crisis, the president of the Federal Reserve Bank of New York faced a crossroads. Congress had set its sights on reform. The biggest banks in the nation had shown that their failure could threaten the entire financial system. Lawmakers wanted new safeguards. The Federal Reserve, and, by dint of its location off Wall Street, the New York Fed, was the logical choice to head the effort. Except it had failed miserably in catching the meltdown. New York Fed President William Dudley had to answer two questions quickly: Why had his institution blown it, and how could it do better? So he called in an outsider, a Columbia University finance professor named David Beim, and granted him unlimited access to investigate. In exchange, the results would remain secret. After interviews with dozens of New York Fed employees, Beim learned something that surprised even him. The most daunting obstacle the New York Fed faced in overseeing the nation’s biggest financial institutions was its own culture. The New York Fed had become too risk-averse and deferential to the banks it supervised. Its examiners feared contradicting bosses, who too often forced their findings into an institutional consensus that watered down much of what they did. [Emphasis added]

This is a challenge for government — particularly in situations where regulators need specific and detailed knowledge to do their jobs. We remember failed oversight that allowed the BP oil spill to happen, for example. [More here.]

There is no easy solution — regulators are not likely to be paid Wall Street salaries. And efforts to prevent regulators from taking future employment — banning them from taking jobs with organizations they regulate — would seem to drive the best and the brightest away from these important jobs.

BloombergNews asked author Michael Lewis, famous for Moneyball and Flash Boys, for his thoughts about the relationship between The Fed and banks:

“The simple answer is that it’s become standard practice for Fed employees to go to work for Wall Street firms, so the last thing they want to do is to alienate those firms and come across as people who don’t ‘get it,’” Lewis wrote to us in an e-mail…

“When you ask a person making $150,000 a year to control a person making $1.5 million a year, you are asking for trouble,” he wrote. “To that, add the problem that the typical Fed regulator is in the awkward position of having to be educated about whatever the Wall Street firm has dreamed up.”

It seems that the other challenge is avoiding group think. Regarding the Great Recession, there were very few people who saw the collapse of the housing market. To the contrary, there were many very smart people — including those in private industry — who made bad bets.

I’m still fascinated by the question about how government gets the best people — in every important position.

The reports from This American Life and ProPublica are a fascinating behind the scenes look at a very challenging government issue.

Related reading: The reports mention a confidential report Columbia professor David Beim wrote for the New York Fed in 2009, as it was trying to figure out why it failed to anticipate the financial crisis and what it should do to make sure it wouldn’t fail to catch the next one.

Photo: Flickr user Michael Daddino

The DorobekINSIDER #GovMustRead list:

- Fence jumper made it deep into the White House [The Washington Post] The man who jumped the White House fence this month and sprinted through the front door made it much farther into the building than previously known, overpowering one Secret Service officer and running through much of the main floor, according to three people familiar with the incident. An alarm box near the front entrance of the White House designed to alert guards to an intruder had been muted at what officers believed was a request of the usher’s office, said a Secret Service official who spoke on the condition of anonymity. The officer posted inside the front door appeared to be delayed in learning that the intruder, Omar Gonzalez, was about to burst through. Officers are trained that, upon learning of an intruder on the grounds — often through the alarm boxes posted around the property — they must immediately lock the front door.

- VA IG unwinds tale of procurement fraud, abuse involving senior agency officials, FedBid [Federal News Radio] A senior Veterans Affairs Department procurement official and executives at a popular federal government contractor are embroiled in a tale of allegedly committing procurement fraud, lying to investigators, retaliating against whistleblowers and misusing agency resources. VA’s Inspector General detailed in an 82-page report, which it released Sept. 26, a story of fraud and abuse that’s right out of the movies. The IG found Susan Taylor, the deputy chief procurement officer in the Veterans Health Administration’s Procurement and Logistics Office, used her position to promote and award a contract to FedBid, a reverse auction vendor, and improperly acted as an agent of the vendor creating a conflict of interest. Investigators also claimed Taylor “improperly disclosed non-public VA information to unauthorized persons, misused her position and VA resources for private gain, and engaged in a prohibited personnel practice when she recommended that a subordinate senior executive service (SES) employee be removed from SES during her probation period.”

- Spy Agencies Urge Caution on Phone Deal [The New York Times] An obscure federal contract for routing phone calls and text messages has prompted a lobbying battle in which intelligence officials argue that surveillance secrets could be at risk.

- Arson at Chicago air traffic center raises questions about background checks [The Washington Post] The arson incident that halted more than a thousand flights at two Chicago airports on Friday revived old questions about the federal government’s ability to screen employees and contractors for potential security risks. Federal Aviation Administration contractor Brian Howard, who allegedly set the fire, posted a Facebook message on Friday saying he planned to “take out” the regional air traffic control center in Aurora, Ill., and commit suicide, according to local CBS and ABC affiliates. Paramedics at the scene followed a blood trail to a basement of the facility, where they found a gas can, burned towels and the suspect, who was “actively slicing his throat,” according to an affidavit posted by the Chicago Tribune.

GovLoop’s DorobekINSIDER water cooler fodder

Before we finish up… a few items from the DorobekINSIDER water-cooler fodder… yes, we’re trying to help you make your water-cooler time better too…

- The DorobekINSIDER Book Club – Join us in reading Frans Johansson’s book: The Medici Effect: Breakthrough Insights at the Intersection of Ideas — and then join the discussion about what the concepts mean for government. More information about how it works here.

- U.S. Forest Service to clarify wild land photography permits, says media won’t be affected [The Washington Post] After receiving complaints about a proposal to require photographers to have a permit to shoot on federal wild lands, the U.S. Forest Service says it will make some changes to ensure it doesn’t violate First Amendment rights. “Based on the feedback we’ve made so far, we’ll make changes to make sure this doesn’t apply to news gathering,” Tom Tidwell, chief of the Forest Service, told The Washington Post. Permits have been required for four years, but only as a temporary “directive” for commercial filming for things like movies and truck commercials. The Forest Service is now seeking to make the policy permanent, Tidwell said.

- Additional information from GovLoop’s DorobekINSDIER: The Forest Service ostensibly tells the public not to comment

- The stars align for baby Charlotte [Politico] Politico interviewed astrologers about the future of Chelsea Clinton’s baby, Charlotte. They predict a future working in social justice and a close relationship with her grandparents.

[…] Best Regulator? That’s Easy. It’s the Market [The Daily Beast] As the Goldman Sachs tapes show, regulators almost always fail. In other cases, they cheat consumers out of choices. Leave it to […]